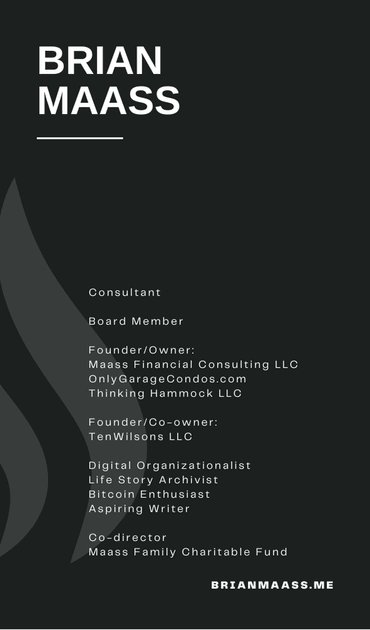

brian maass

My Reluctant Path to Bitcoin

skeptic --> curious learner --> advocate --> enthusiast --> investor

I spent 25+ years in senior and executive roles in TradFi. I was reluctant to acknowledge bitcoin. I'm a value investor and I loved Berkshire Hathaway and Warren Buffet so I was just parroting his view of bitcoin.

Then starting in late 2020, I got curious and started investigating bitcoin expecting to confirm my dismissal. I read several books, listened to many podcasts and started to follow bitcoin twitter and bitcoin influencers who had spent years understanding bitcoin and its possibilities. After hundreds of hours, I started to be able to separate the noise from the signal.

Links-->

Bitcoin separates itself as a commodity (June 2022)

Bitcoin Spot ETFs approved in US (January 2024)

2024 Bitcoin Outlook - ETFs will be a game changer

Is Bitcoin Digital Gold?

Gold vs Bitcoin in 2025

Traits of Money

Bitcoin's market cap of ~$2T represents about 11% of gold's market cap of ~$18T.

Bitcoin is a better form of money. It has the decentralization and scarcity of gold, but better divisibility, portability, scarcity, and verifiability. It's relatively harder to tell if gold is pure, or contains some lead in the middle of the bar. In the next 5-10 years, Bitcoin's market cap could surpass Gold.

Only 2 main narratives in 2021

Price/Volatility and Technical Discussions

In 2021, I wrote a series of short form essays (12) in public on twitter as I continued to learn and understand more about bitcoin. I realized there were only 2 types of conversations or narratives about bitcoin at that time. One was CNBC only talking about bitcoins price and its volatility and the second was people talking about the technical components about how the technology actually works (crytopgraphy, mining, hash rate, etc.). Then I separated the signal from the noise!

Bitcoin Use Cases

Ignore the Noise and follow the signal

As an experienced global finance executive, I started to see how bitcoin could solve several problems. My breakthrough was in ignoring the mainstream conversations about price volatility and technical components. I realized I don't really know how my car engine works (compressed air, cylinders, etc.) but I still drive a car. I don't really know how the internet technically works (http protocol layer, servers, routers) but I still use websites and shop online. So maybe I could ignore the technical components and price volatility and just focus on what the bitcoin network could do better than existing systems. I first tweeted about this in October 2021. Here is my running list of potential bitcoin use cases:

Store of Value

Better store of value than gold - Digital Gold

Billionaire hedge-fund manager Paul Tudor Jones prefers Bitcoin

over gold as a hedge against inflation.

Gold Market Cap ~11T

Bitcoin Market Cap ~1T

Money Transfer

Replace VISA/Mastercard and ACH with something faster and cheaper

VISA/MC charge merchants 1-3.5%

ACH bank transfer 2-3 days

lightening network can settle instantly at virtually no cost

Foreign Currency Remittances

Replace Western Union with something faster and cheaper

President of El Salvador estimates that money services providers like WU / MoneyGram will lose $400 million a year in commissions for remittances, due to 1 country's

adoption in Sept 2021.

Foreign Currency Exchange

Replace Foreign currency exchange with something faster and cheaper

Consumers traveling abroad OR global / small businesses pay massive FX fees to convert and pay in local currencies.

Bitcoin lightening network can transfer value instantly at minimal cost

Instead of Negative Yielding Bonds

Better store of value than 15T of negative yielding bonds

15T of gov't bonds trading with negative yields. Investors are just looking for store of value.

Bitcoin is a better alternative

Hedge against Money Printing

Best hedge against money printing & hyper-inflation

Almost all central banks (including US) keep printing money. At the individual or business level you can't borrow your way to prosperity. It's not going to work for governments long term.

Big Debt Crisis

Wealth Transportability

Refugees can walk across a border and reauthenticate wealth elsewhere

This has never been possible! Try fleeing a country in turmoil with gold in your pockets. Enables wealth to exit jurisdictions/regimes without the threat of arbitrary confiscation. Flee dictatorship with one' savings intact. Many examples of human empowerment in third world countries and likely to be more in the future!

Better value than Global Debt

Best hedge or store of value against 400T in global debt

Global debt is a 400T asset that is programmed to debase and 60%/40% stock/bond allocation is outdated.

Hedge for weak currencies (hyper-inflation)

Best hedge against currency defaults

Inflation will be overwhelmed by credit risk. Even if it's not the US there are ~150 other currencies that risk debasement or hyper inflation.

Bitcoin is default insurance or a hedge against any basket of sovereigns

Helps monetize stranded energy assets

Creating new renewable energy

Bitcoin mining operations are location-agnostic energy buyers. This means that energy resources that were previously uneconomical to develop should be re-assessed under these new assumptions and variables.

Bitcoin is now being mined by what was otherwise stranded renewable energy (volcanos in El Salvador; Hydroelectric dams in the Appalachians, etc.)

Hedge for inflation

Fixed supply - unlike USD or other fiat currencies

In a world of fiat currencies where debasement is unpredictable yet accepted, bitcoin’s preset monetary policy with a fixed terminal supply is a contrasting system that removes intentional destruction of purchasing

power.

High value settlements

Similar to FedWire but decentralized and final

The bitcoin network enables moving a billion dollars worth of value across the world, securely and in minutes, for less than a few dollars. It's becoming a more attractive method of final settlement for high-value transactions than traditional financial infrastructure.

Liquid alternative to many store of value assets

no storage or maintenance cost like many physical assets

A challenge with many physical store of value assets (fine wine, vintage cars, high-end art) is storage, maintenance and authentication. Bitcoin, being purely digital and publicly auditable, has no such costs. In addition, it offers significantly greater liquidity, trading 24/7 in a truly global market.

Collateral Lending

Ultimate bearer asset - easily valued 24/7/365

The credibility of bitcoin’s scarcity (independently verifiable via a full node) as a bearer asset makes it an ideal form of collateral in transactions. We are now seeing an explosion in fiat-denominated lending due to its tax advantages.

Additionally, the programmable nature of bitcoin (i.e. multi-signature custody schemes) add a layer of flexibility to loan agreements

Time Locked Contracts

Ability to fix future payouts based upon specific terms

The combination of cryptography, digital signatures and hash functions allows us to create time-based escrows. Hashed Time Lock Contracts (HTLCs) are conditional payments that require the recipient to acknowledge they’ve

received a payment by a set deadline or forfeit the right the claim it.2025 Bitcoin updates

Bitcoin updates (2024)

© 2025