brian maass

Berkshire Hathaway

Berkshire Hathaway (BRK.A / BRK.B) rallied to numerous all-time highs in 2024 and even crossed a market cap of over $1 trillion in late August 2024. There are only 6 other US companies with a higher valuation.

Despite this seemingly high valuation, Berkshire is a compounding machine having retained nearly all of its $696 billion in earnings. No company has ever done anything like this! It's almost as if Warren is using Berkshire as an academic exercise on compounding.

Since 2018, operating earnings are accelerating faster and share repurchases have increased. See analysis on share repurchases, updated intrinsic value estimates and 2024 price targets.

BRK.A = 1,500 shares BRK.B

BRK.A currently trades at .1% premium to BRK.B

History of Berkshire Share Repurchases

Why is this 2018 change so significant?

Berkshire Hathaway has only changed its buyback philosophy 3 times in almost 60 years (2011, 2012 and 2018). These changes are not done without lots of intentional considerations. Since this last share repurchase authorization change in 2018, Berkshire Hathaway has consistently been repurchasing shares of the company. In fact, Berkshire has repurchased over 13% of the company shares and is generating cash such that they still have record amounts of cash on hand ($334+ billion as of December 2024). The BRK.A share price before this 2018 change was $288,500.

On February 28, 2025, BRK.A shares closed at $775,000 which is a 153% return since July 2018. This exceeds S&P returns over that same time period (~112% total return with dividends reinvested).

What do we know? Berkshire is still trading at less than its intrinsic valuation (conservatively determined) as defined in the Berkshire's share repurchase authorization. All I know, is Warren has proven very conservative over the last 50-60 years. These repurchases are added significant value to the remaining shareholders. So what is the intrinsic value of Berkshire Hathaway?

In Berkshire's August 2024 SEC filing, share repurchases continued (but at a reduced rate) even as the share price continues to increase over $625,000+ share.

In Berkshire's November 2, 2024 and February 22, 2025 SEC Filings, no share repurchase in Q3 or Q4 2024

Intrinsic Value of Berkshire

Grok-3 calculates the intrinsic value of Berkshire Hathaway using only Warren Buffet's words and method as shared in annual letters or interviews. It is then written using Warren Buffet's tone and style.

$1.4 Trillion or $985,000 per BRK.A Share

Alright, folks, let’s sit down and figure out what Berkshire Hathaway’s really worth—its intrinsic value, as I like to call it. You’ve heard me say time and again that intrinsic value is the only sensible way to judge a business. It’s not about what the stock ticker says today or what some Wall Street fella scribbles on his notepad. No, it’s about the cash a company can put in your pocket over its lifetime, discounted back to right now so we can make sense of it.

For Berkshire, we’ve got two big buckets to think about: our operating businesses and our investments. The operating businesses are the heart of the operation—companies like GEICO, BNSF, and our energy outfits. They’re the engines that keep chugging along, throwing off earnings year after year. Then, over here, we’ve got a hefty pile of investments: cash and stocks that we’ve tucked away for a rainy day or a good opportunity.

Step 1: Valuing the Operating Businesses

Let’s start with those operating businesses. In 2024, they kicked out $47.4 billion in operating earnings. Now, if these were just run-of-the-mill companies, you might say, “Well, Warren, let’s slap a multiple of 15 on those earnings and call it a day.” That’d give us about $711 billion, and we could head home early. But hold on—our businesses aren’t average. They’ve got wide moats around them, good management, and room to grow. So maybe 15 times earnings is selling them short.

To get a better grip, let’s think about what those earnings could do over time. Suppose we figure they’ll grow at 5% a year for the next 10 years—nothing crazy, just steady progress. After that, let’s say they settle down to 3% growth forever, like a nice, dependable plow horse. Now, we need to discount those future dollars back to today. I like to use 10%—it’s a solid rate that reflects what you might expect from a good business over the long haul.

Here’s how it shakes out:

- First 10 Years: Starting with $47.4 billion in 2024, growing at 5%, we get $49.77 billion in 2025, and so on up to about $77.2 billion by 2034. Discounting each year’s earnings back at 10%, that adds up to roughly $371 billion in today’s dollars.

- After That: In year 11, earnings hit $79.52 billion (that’s $77.2 billion times 1.03). For the perpetual value, we take that $79.52 billion and divide by 7% (10% discount rate minus 3% growth), giving us $1,136 billion in 2034 dollars. Discount that back 10 years at 10%, and it’s worth about $438 billion today.

- Total: Add $371 billion and $438 billion, and the operating businesses come to around $809 billion.

Step 2: Adding the Investments

Now, let’s look at the other bucket. As of December 31, 2024, we’ve got $334 billion in cash and $272 billion in equities—stocks like Apple and Coca-Cola that we’ve held onto because they’re darn good companies. Add those together, and you’ve got $606 billion. That’s straightforward—no fancy math needed. It’s money in the bank or in the market, ready to work for us.

Step 3: Putting It All Together

So, here’s the tally:

- Operating businesses: $809 billion

- Investments: $606 billion

- Total Intrinsic Value: $1,415 billion

We’ve got about 1.437 million Class A share equivalents outstanding. Divide $1,415 billion by 1.437 million, and you land at roughly $985,000 per share.

A Word of Caution

Now, don’t go carving that $985,000 in stone. Intrinsic value isn’t like balancing your checkbook—it’s an estimate, a best guess based on what we know today. It’s like sizing up a farm: you can count the acres and check the soil, but two farmers might still come up with different numbers. I’d say we’re in the ballpark, maybe off by 10% either way, and that’s fine. The trick is to stay conservative and not fool ourselves into seeing what we want to see.

And here’s something else: this doesn’t bake in any extra value for having all these businesses under one roof, or for me and the team steering the ship. Some folks might argue there’s a premium there, and maybe there is, but I’d rather stick to the numbers we can touch and feel.

The Bottom Line

So, there you have it, plain and simple. Based on Berkshire’s 2024 financials—$47.4 billion in operating earnings, $606 billion in investments, and 1.437 million shares—I’d peg the intrinsic value at around $985,000 per share. But don’t just take my word for it. Grab a pencil, run the numbers yourself, and see where you land. It’s your money, after all, and nobody’s going to care about it more than you do. That’s how we do things around here—think hard, keep it honest, and always look ahead.

Other intrinsic value estimates of Berkshire Hathaway

2 well-know individuals focused on understanding the components of Berkshire Hathaway

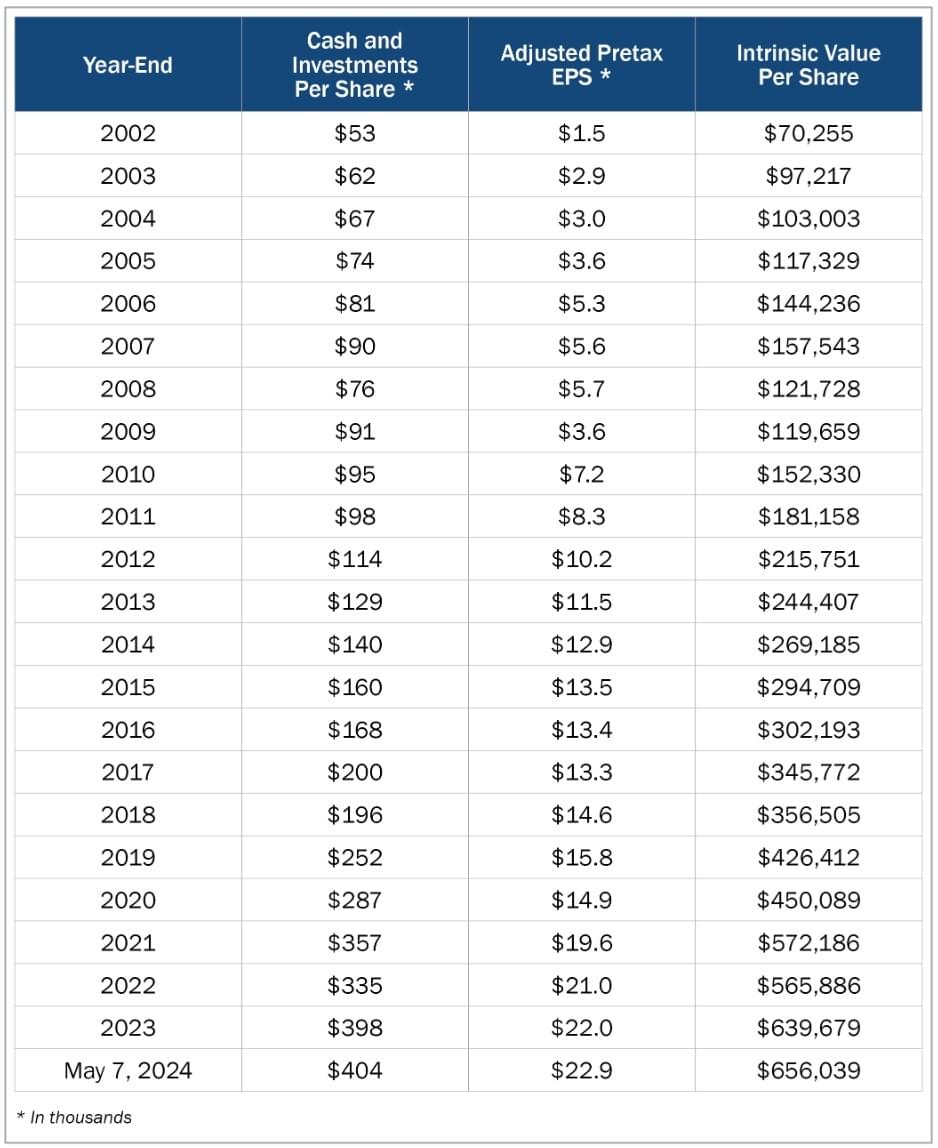

Semper Augustus

Annual intrinsic value analysis (~60 pages) by Christoper Bloomstrand of Semper Augustus Investment Group LLC

2023 - $1.035 trillion (updated May 2024) ~$720,125/ share

2022 - $923 billion

2021 - $889 billion

2020 - $791 billion

2019 - $760 billion

2018 - $791 billion

2017 - $611 billion

Whitney Tilson

Annual intrinsic value estimate by Whitney Tilson of Stansberry Research

May2024 - $656,039

Feb2024 - $651,056

2023 - $639,679

2022 - $565,886

2021 - $572,186

2020 - $450,089

2019 - $426,412

2018 - $356,505

2017 - $345,772

Berkshire Analyst 2025 Target Prices

BRK.A - Analyst Price Targets

$836,125 - Feb2025 - UBS - Brian Meredith

$775,000 - Feb2025 - KBW - Meyer Sheilds

$807,000 - Oct2024 - UBS - Brian Meredith

$735,000 - Oct2024 - KBW - Meyer Shields

$721,500 - Apr2024 - UBS - Brian Meredith (+6,500)

$715,000 - Feb2024 - UBS - Brian Meredith (+$60,000)

$708,000 - Feb2024 - CFRA Research - Cathy Seifert

$645,000 - Feb2024 - KBW - Meyer Shields (+$35,000)

$655,000 - Jan2024 - UBS - Brian Meredith (+$30,000)

BRK.B - Analyst Price Targets

$557 - Feb2025 - UBS - Brian Meredith

$516 - Feb2025 - KBW - Meyer Sheilds

$538 - Oct2024 - UBS - Brian Meredith

$490 - Oct2024 - KBW - Meyer Shields

$481 - Apr2024 - UBS - Brian Meredith

$477 - Feb2024 - UBS - Brian Meredith

$472 - Feb2024 - CFRA Research - Cathy Seifert

$430 - Feb2024 - KBW - Meyer Shields

$435 - Jan2024 - UBS - Brian Meredith

© 2024